Put option formula

Call option C and put option P prices are calculated using the. Ad From Implied Volatility to Put-Call Ratios Get the Data You Need.

Must Know Cfa Formulas Business Insider Fisher College Of Business Business Insider Formula

P Price of the Put Option.

. Analogous to the Proof of the Bachelier call formula. Two months later the option is about to expire and the stock is trading at 8. Blacksquare Do the Bachelier formulas satisfy the Call-Put parity.

NEW MOCKS debrief videos and Read the Mind. Put options profit or loss formula. If you want to calculate the value of the put option then we will need 2 parameters.

Learn more 20 off BPP Books for ACCA CIMA exams - Get BPP Discount Code. The formula for put call parity is as follows-. Smart Options Strategies shows how to safely trade options on a shoestring budget.

Options risk management valuation and pricing Description Formula for the calculation of the theta of a put option. Calculating the profit or loss that will be incurred when a put option is exercised is gotten by finding the difference between the strike price of the underlying. Dona also bought 50 American put options with.

A put options intrinsic value is the amount by which the puts strike price is higher than the current market price of the underlying stock. Smart Options Strategies shows how to safely trade options on a shoestring budget. Delta of a put option Tags.

Ad From Implied Volatility to Put-Call Ratios Get the Data You Need. Put Option Formula. The Call-Put parity can be stated as follows.

The strike is 47 in this case and Bank of America. Rho is an option values sensitivity to a change of the TRM02271Srisk-free interest rateTRM02271E. Formula for the calculation of the rho of a put option.

Call and Put Option Price Formulas. The delta of an option. Since an American option is more flexible than a European option it has higher value.

Ad Download Smart Options Strategies free today to see how to safely trade options. A Superior Option for Options Trading. 7 hours agoAt Stock Options Channel our YieldBoost formula has looked up and down the HOOD options chain for the new October 28th contracts and identified one put and one call.

Options risk management valuation and pricing Description Formula for the calculation of a put options delta. For example the 11 put may have cost 065 x 100 shares or 65 plus commissions. Free Education No Hidden Fees and 247 Support.

Theta measures the option values sensitivity to. Theta of a put option Tags. C P S PV x Where C Price of the Call Option.

Ad Download Smart Options Strategies free today to see how to safely trade options. S Spot Price. The exercise price The current market price of the underlying asset.

PV x Present Value of the Strike. Dividend yield was only added by Merton in Theory of Rational Option Pricing 1973.

Icse Soiutions For Class 10 Mathematics Factorization Maths Formula Book Mathematics Math Methods

Selina Concise Mathematics Class 9 Icse Solutions Compound Interest Using Formula A Plus Topper Student Problem Solving Physics Books Mathematics

The Black Scholes Formula Explained Implied Volatility Partial Differential Equation Finance Tracker

Pin By Arturo Rodriguez On Finance Option Pricing Pricing Formula Stock Options

Put Call Parity Refers To The Static Price Relationship Between The Prices Of Put And Call Options Of An Asset With Th Exam Fisher College Of Business Formula

Interesting Bk Put And Call Options For April 15th Call Option Options Bank

Pin By Anand Masurkar On Stock Market Quotes Stock Market Quotes Marketing Meme Stock Market

Rd Sharma Class 11 Solutions Chapter 23 Straight Lines Ex 23 15 Math Vocabulary Solutions Class

Pin On Options

Markup Percent Calculations Excel Calculator Page Layout

Interesting Yum Put And Call Options For February 26th Call Option Options February

Dvn May 6th Options Begin Trading Options Begin May

Circle Formulas Gcse Math Math Methods Studying Math

Interesting Siri Put And Call Options For August 28th Call Option Options August 28

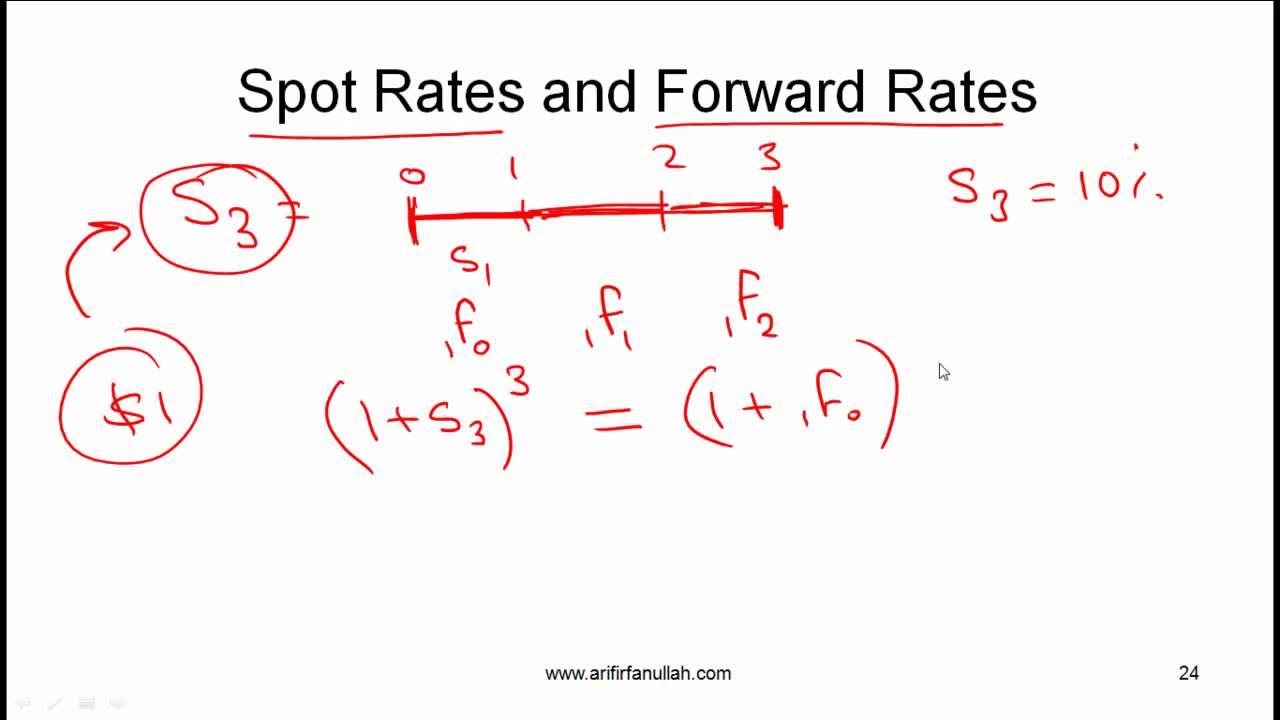

Cfa Level I Yield Measures Spot And Forward Rates Video Lecture By Mr Arif Irfanullah Part 5 Youtube Lecture Mr Video

First Week Of November 20th Options Trading For Tata Motors Ttm Option Trading Trading Call Option

First Week Of October 16th Options Trading For Enterprise Products Partners Epd Option Trading Trading Options